Test Owner

Plans are accelerating for a major £500 million regeneration of Wythenshawe Town Centre in Manchester, with new developments including residential housing, cultural spaces, commercial areas, and public realm improvements. For the data cabling and telecoms infrastructure sector, projects of this scale represent significant long-term opportunities across multiple phases of delivery.

The latest proposals include a new food hall as part of the wider transformation of the Civic shopping centre, alongside a £32 million Culture Hub currently being delivered by Kier. Developers are also progressing plans for hundreds of new homes, with up to 2,000 residential units expected over the next 10 to 15 years.

This type of mixed-use regeneration requires extensive digital connectivity, structured cabling systems, fibre infrastructure, and smart building technologies from the ground up.

Why Regeneration Projects Drive Demand for Data Cabling

Large urban regeneration schemes are no longer just construction projects. They are digital infrastructure programmes.

Modern developments require:

- • Structured cabling installation

• Fibre optic backbone networks

• Smart building systems integration

• Wi-Fi and connectivity infrastructure

• Security, access control, and IoT cabling

• Data centre and edge computing connectivity

With new office space, community facilities, and residential buildings planned, Wythenshawe will require high-performance network infrastructure to support businesses, residents, and public services.

Multi-Phase Opportunities for Contractors and Engineers

One of the key advantages of regeneration schemes is the long delivery timeline. The Wythenshawe masterplan spans over a decade, creating sustained demand for:

- • Data cabling engineers

• Fibre splicing technicians

• Network infrastructure installers

• AV and security cabling specialists

• Project managers and site supervisors

For recruitment companies specialising in telecoms and structured cabling, these developments create repeat demand across multiple project phases rather than a single short-term contract.

Smart Cities and Connected Communities

The regeneration also reflects a broader UK trend toward connected communities and smart city technology. Developments now integrate:

- • Energy monitoring systems

• Smart lighting

• Public Wi-Fi networks

• Digital transport infrastructure

• Building management systems

These systems rely heavily on robust structured cabling design and installation from day one.

As sustainability and net-zero targets become more important, digital infrastructure will play a critical role in monitoring energy performance and supporting efficient building operations.

What This Means for the Data Cabling Industry

Projects like Wythenshawe demonstrate that the UK construction pipeline remains strong for telecoms infrastructure specialists, particularly in:

Manchester

North West England

Urban regeneration zones

Mixed-use developments

Public sector funded schemes

For companies operating in the data cabling sector, early engagement with contractors and developers is key to securing opportunities across planning, build, and fit-out stages.

Conclusion

The £500m Wythenshawe regeneration is more than a construction story. It is a digital infrastructure opportunity that will generate sustained demand for data cabling engineers, fibre specialists, and connectivity experts over the next decade.

As UK towns and cities continue investing in regeneration, the importance of high-quality network infrastructure will only grow.

The acceleration of digital healthcare since the pandemic has fundamentally changed how NHS estates think about network infrastructure. Connectivity is no longer treated as a supporting IT layer. It is now viewed as operational and, in many cases, clinically critical.

As a result, structured cabling and physical network design are being pulled earlier into both refurbishment and new-build conversations, creating sustained opportunity for cabling specialists who can deliver safely in live environments and to defined standards.

Digital healthcare has moved from optional to operational

National NHS guidance increasingly frames connectivity as a prerequisite for modern care delivery. Virtual wards, electronic patient records, diagnostics, asset tracking, and mobile clinical workflows all depend on reliable, resilient networks.

This shift is important. It means infrastructure is being designed with future demand in mind, rather than installed to minimum day-one requirements. Capacity headroom, resilience, and maintainability are now explicit considerations in many healthcare projects.

For cabling contractors, that translates into clearer specifications and less tolerance for informal or undocumented installs.

Refurbishment of live hospitals is driving consistent demand

Much of the current workload is not headline-grabbing new builds, but refurbishment within live hospitals.

Ageing comms rooms, congested risers, undocumented containment routes, and legacy copper and fibre are being addressed as part of wider estates upgrades. These works are often phased, out-of-hours, and delivered alongside clinical activity, which places a premium on methodical planning and experienced delivery teams.

This type of work is repeatable and long-term. Estates teams are focused on remediation and future-proofing rather than one-off refreshes.

Wireless-first strategies are increasing cabling requirements

Healthcare is increasingly described as “wireless-first”, but this has not reduced cabling demand. In practice, it has increased it.

High-density wireless deployments require:

- More access points

- More PoE-capable ports

- Stronger and better-documented wired backbones

- Clean containment and routing to allow future expansion

National wireless infrastructure guidance explicitly highlights the importance of the underlying wired network. The result is more ceiling and corridor cabling, more terminations, and greater emphasis on testing and documentation.

New health projects are more prescriptive, not less

Government-funded healthcare projects, including hospital redevelopments and primary care facilities, are increasingly standardised in design.

Minimum cabling categories, fibre types, testing regimes, and documentation requirements are commonly specified upfront. This reflects a desire to reduce long-term operational risk and improve consistency across estates.

For delivery partners, this reduces ambiguity. Success is less about improvisation and more about delivering precisely to specification.

Documentation and maintainability are now operational priorities

One of the clearest changes on healthcare projects is the emphasis on handover quality.

Many trusts are dealing with the consequences of poorly documented historical installs. As a result, new works frequently require:

- Full certification results

- Consistent labelling schemes

- Accurate as-built drawings

- Clear O&M documentation

This is not box-ticking. Estates and IT teams increasingly treat documentation quality as essential to uptime, fault resolution, and future upgrades.

What this means for cabling professionals

Healthcare is not a fast or casual market, but it is a durable one. The opportunity sits with contractors who can demonstrate:

- Experience working in live clinical environments

- Strong planning, access control, and risk management

- High standards of testing, labelling, and documentation

- An understanding of future capacity and resilience, not just installation

Those capabilities are increasingly valued over lowest-cost delivery.

Closing thought

As healthcare estates modernise, the physical network is being recognised as critical infrastructure rather than background IT. That creates sustained, standards-driven demand for structured cabling professionals who can deliver safely, accurately, and with long-term performance in mind.

For those operators, healthcare represents not just short-term project work, but repeatable opportunity over the coming decade.

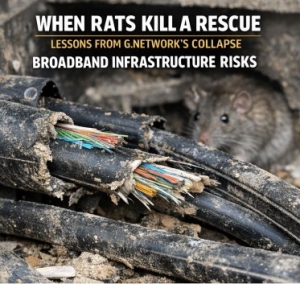

When Rats Kill a Rescue: What G.Network’s Collapse Says About UK Broadband Infrastructure

The cost of copper is increasing and it is becoming a growing consideration for construction projects, particularly across data cabling, electrical, and infrastructure works. This is not limited to the UK, with similar copper price pressure being seen across multiple international markets. As a result, copper pricing is being influenced by wider global market conditions rather than local factors alone.

Part of this increase is driven by the wider rise in metal costs. Copper is a widely used construction metal, so when base metal prices move up, copper tends to follow. This impact is being amplified by tighter supply, meaning material price increases are felt more quickly and passed through the construction supply chain.

The implications are now being seen across live construction projects and planned developments. Material costs are coming in higher than originally expected, project budgets are being revisited, and procurement decisions are taking longer. In some cases, scheduled construction projects have been pushed back or paused while pricing is reassessed or funding is reviewed.

For contractors, this creates margin pressure, particularly where fixed pricing was agreed earlier in the project lifecycle. For clients and developers, it increases the likelihood of repricing, programme delays, or scope changes as rising input costs are worked through.

The takeaway is simple: copper should no longer be treated as a stable background cost. Rising copper prices, higher metal costs, and tighter material supply mean it is now a live factor in construction pricing, procurement, and project delivery.

Is anyone else seeing similar project delays, repricing, or project pushbacks in their market?

Planning activity for new data centres in England and Wales hit a record high in 2025, with applications rising 63 percent compared with 2024. That spike reflects intensifying demand for computing capacity driven by cloud services and artificial intelligence (AI) workloads.

According to analysis cited by Data Centre Review, more than 60 new planning applications for data centres were lodged in local planning systems last year. The figure excludes extensions to existing facilities and mixed-use developments that include data centre components, meaning the actual volume of data-related proposals moving through planning could be even higher.

What’s Driving the Surge

Several factors are fuelling this acceleration in planning demand:

- AI and cloud compute growth: Major technology companies are investing heavily in infrastructure to support AI, machine learning and cloud services. Hyperscale providers such as Google, Microsoft and OpenAI are expanding their global footprints, and the UK has emerged as a key strategic market.

- Competition for land and power assets: Developers are increasingly targeting non-traditional sites, from former hotels and industrial land to brownfield locations that offer proximity to power and connectivity.

- Geographic spread: While London and the South East remain hotspots, applications have broadened into the Midlands, North West, Yorkshire and Wales, driven by land, cost and grid considerations.

Beyond the Numbers

This planning surge takes place amid wider industry dynamics:

- The UK data centre market has been designated a Critical National Infrastructure, with government support for new facilities and initiatives to streamline connections to power grids.

- Despite strong interest, power availability and grid constraints are emerging as a key bottleneck for developers, prompting innovation in energy solutions and planning approaches.

- The broader global outlook remains one of rapid expansion, with industry forecasts predicting continued capacity growth through to 2030 as AI and cloud demand escalates.

What This Means for the UK Industry

The record-setting planning figures highlight several important trends:

- Growing confidence in digital infrastructure investment. Investors and developers are clearly bullish on future demand, submitting ambitious proposals even in competitive planning environments.

- Increased pressure on planning systems. Local authorities may face rising workloads and challenges in balancing development interests with community and environmental concerns.

- A shift in where data centres are being proposed. With costs and capacity constraints rising in traditional hubs, new regions are coming into focus for developers looking to secure sites with available power and space.

- Policy and infrastructure will matter more than ever. Grid capacity, streamlined approvals and supportive local policy will be crucial to turn planning applications into operational facilities.

The UK’s data-centre boom is accelerating at a pace few people outside the industry truly appreciate.

Driven by artificial intelligence, cloud computing, fintech, streaming, defence, and hyperscale platforms, Britain is now Europe’s largest data-centre market by several measures. From west London to Hertfordshire, Manchester, and Scotland, industrial estates, farmland and brownfield sites are being rapidly converted into secure, power-hungry digital infrastructure.

That growth is economically powerful. But it is also changing how energy, land and planning work in the UK.

For clients, contractors and investors in our sector, understanding what is happening behind the headlines matters.

Data centres now rival entire cities for power

A single hyperscale data centre can consume as much electricity as 100,000 homes. The UK currently has around 480 data centres, and that number is forecast to exceed 580 within five years.

More importantly, their share of national electricity demand is rising fast:

Year Share of UK electricity

2024 2.5%

2030 (forecast) 10%

That is not just an IT story. It is a national infrastructure shift.

Electricity networks, substations, transmission lines and grid connections were not designed for dozens of multi-hundred-megawatt industrial users suddenly plugging into the system in the same postcodes.

This is now one of the biggest bottlenecks facing UK data-centre development.

Why grid capacity is becoming the new planning constraint

In west London and parts of the Southeast, new data-centre projects are already being delayed because the grid physically cannot supply any more power without major upgrades.

The same problem is beginning to affect housing, commercial property and industrial development. Where data centres cluster, they absorb large amounts of available capacity, forcing other projects to wait years for a connection.

From a construction and engineering perspective, this is now creating a second boom alongside data-centre build:

- New substations

- High-voltage cabling

- Grid reinforcements

- Power-routing infrastructure

- Backup generation and battery storage

This is becoming a multi-billion-pound industry in its own right.

Who ultimately pays for those upgrades?

Here is where the issue becomes sensitive.

In the UK, most transmission and distribution upgrades are funded through network charges. These are embedded in every electricity bill.

That means:

When the grid is reinforced to support data centres, the cost is typically spread across all users, not just the data centres themselves.

Households, SMEs and local businesses therefore share in paying for infrastructure built to serve energy-intensive digital industries.

This is not unique to data centres. It is how the UK energy system has always worked. But the scale and speed of AI-driven demand is unprecedented.

Why the Government is actively encouraging this growth

The UK government has classified data centres as critical national infrastructure. This gives them faster planning approval and makes them strategically protected.

At the same time, the Government is creating AI Growth Zones in areas with surplus renewable energy, particularly in Scotland, where wind generation is sometimes curtailed because the grid cannot move power south quickly enough.

The strategy is simple:

- Put data centres close to where power is abundant

- Reduce waste from unused renewable generation

- Avoid overloading the Southeast

Long-term, this should lower system costs. Short-term, it requires enormous investment in transmission networks.

What this means for the industry

For companies like Bauhaus and the engineers we support, this trend is structurally positive.

Data centres are no longer niche projects. They sit at the intersection of:

- AI

- Defence

- Finance

- Cloud

- Cybersecurity

- National resilience

- Energy infrastructure

That means sustained long-term demand for:

- Structured cabling

- Fibre networks

- OTDR and testing engineers

- Power and containment specialists

- Build, fit-out and maintenance labour

The UK is not building these sites for fashion or hype. They are being built because the digital economy depends on them.

The reality behind the headlines

Local resistance, particularly in green-belt areas, is understandable. Nobody likes seeing open land replaced by industrial buildings.

At the same time, modern data centres are not warehouses. They are:

- Highly secure

- Often powered by 100 percent renewable electricity

- Designed for heat-recovery and district heating

- Required to deliver biodiversity net gains

- Built to strict environmental standards

The bigger issue is not whether data centres should exist.

It is how Britain upgrades its grid fast enough to support them without unfairly pushing costs onto households.

That challenge is now firmly on the national agenda.

Bottom line

Data centres are becoming as essential to Britain’s economy as railways, ports and motorways.

They will change how land is used, how electricity flows and where investment goes.

For the digital infrastructure sector, that means opportunity.

For the energy system, it means transformation.

And for everyone, it means the UK is entering a new phase of being a truly AI-powered economy.

The new UK Budget delivers targeted changes rather than major reform, but several of the announcements have a direct impact on the structured cabling, fibre and data centre labour market. Below is a clear and practical breakdown from the perspective of Bauhaus Recruitment and the companies and engineers we support.

Minimum Wage Rise

The Government has increased the National Minimum Wage. For many people this is a positive step, but there is a bigger picture. In technical and construction trades the impact becomes more complicated, often leading to reduced junior hiring and potentially higher unemployment for young people.

Impact on Data Cabling Firms

Data cabling companies work on tight margins. When minimum wage rises, the cost of hiring young and inexperienced workers rises immediately, but their productivity does not rise at the same pace.

This usually results in:

• Fewer trainee cable pullers

• Fewer 18 to 21 year olds being taken on

• A stronger reliance on experienced hands who can deliver from day one

Because most cabling and data centre projects are time sensitive, companies have less room to take risks with junior staff. The result is often higher youth unemployment in the trade.

Knock On Effect Across Other Trades

Skilled trades such as M&E engineers and electricians are not minimum wage roles. However, many general construction positions are either on the minimum wage or only slightly above it. This includes labourers, site operatives, cleaners, gate staff, basic demolition labour and general mates. These roles form the backbone of early-stage construction work.

When minimum wage rises, these general labour roles become more expensive and companies often reduce headcount to manage costs. Because these teams usually work before the cabling phase, any slowdown on their side delays everything that follows.

If fewer labourers are available to clear areas, move materials, build basic structures or prepare rooms, the entire site progresses more slowly. Cable routes are handed over later, containment areas are finished later and rooms are signed off later. This leaves cabling teams working in compressed timeframes or waiting around for handover, increasing overall project pressure and the risk of delays.

Apprenticeships: A Partial Solution

Some employers will look toward apprenticeships, but the system is not a quick fix.

Large Employers

Companies with a payroll over £3m pay the Apprenticeship Levy at 0.5 percent of their payroll. This creates a pot of money that must be used for apprenticeship training. In theory they can take on as many apprentices as the pot covers, but in practice most only bring in a small intake each year because proper supervision and training still require time and resources.

Smaller Employers

Companies under the £3m payroll threshold do not pay the levy. The Government funds 95 percent of the training cost and the employer pays the remaining 5 percent. However, the employer still pays the apprentice wage, PPE, tools and carries the impact of slower productivity.

What the Levy Pays For

The levy only covers the training and qualification, not wages or on site supervision. This is the main reason companies keep apprentice numbers low.

How Many Apprentices Can a Cabling Firm Take?

There is no official limit, but most firms can only manage one or two apprentices at a time due to the training workload and project pressures. Apprentices help long term, but they do not solve immediate labour shortages.

Scrapping the Two Child Benefit Cap

The Government has removed the two child benefit cap. This increases support for larger families and boosts household income.

Industry Angle

Higher disposable income tends to support technology spending over time, which strengthens demand for home connectivity, broadband upgrades and related installation work. While not a direct driver for structured cabling firms, it contributes positively to the overall market climate.

Infrastructure and Digital Commitments

The Budget confirmed that digital infrastructure remains a national priority. While there were no dramatic new programmes, the Government continues to support areas that matter for our sector, including:

- • Fibre expansion

• 5G densification

• Data resilience

• Public sector data centre consolidation

• Energy efficiency upgrades for enterprise and hyperscale facilities

Every rise in mobile and cloud usage increases reliance on the core fibre network, which keeps demand high for structured cabling engineers and surveyors.

Funding to Devolved Regions

Northern Ireland received an additional £370m in funding, with further targeted support for Wales and the North.

Impact on Cabling and DC Work

Regional investment often leads to:

• Telecom upgrades

• Modernisation of public buildings

• Local data centre enhancements

• Increased demand for labour

These pockets of activity can create strong regional demand for skilled data cabling and fibre engineers.

Pensions

The Government has introduced a new limit on pension salary sacrifice, capping the tax-free element at £2,000 per year. Anything above this no longer benefits from the same National Insurance savings, which reduces the attractiveness of larger salary sacrifice arrangements used by many directors and high earners.

Employer pension contributions are still deductible for corporation tax purposes, which keeps them efficient for long term planning. However, this new cap affects directors, contractors and business owners who previously used larger sacrifice strategies.

Dividend Tax

Dividend tax rates will rise by 2% percentage points from April 2026, increasing the tax burden on directors who pay themselves through dividends. The tax-free dividend allowance remains at £500, which is already far lower than previous years. With higher rates and a very small allowance, the gap between salary and dividend efficiency continues to narrow.

This change particularly affects engineers operating through their own limited companies, as well as owners of small cabling firms who rely on a blend of salary and dividends for income.

General Economic Conditions

The Budget aims for stability rather than aggressive spending. However, the wider sentiment among SMEs is that the Budget feels tougher on small businesses and less supportive of private investment. Higher taxes, reduced allowances and rising employment costs are increasing pressure on smaller firms, including many within the cabling and wider construction supply chain.

For the structured cabling and data centre ecosystem, stability can still be positive in certain areas. It supports steady digital infrastructure investment and gives larger enterprise clients enough confidence to move ahead with upgrades and new facility builds. At the SME level though, tighter margins and higher operating costs may slow hiring, limit junior intake and reduce appetite for risk, which feeds into the already widening skills gap.

Bauhaus Recruitment Outlook for 2025

Based on current market conditions, the next year is likely to bring:

• Strong demand for structured cabling, fibre and data centre engineers

• Increased competition for surveyors with Ekahau and iBwave skills

• Clients seeking flexible, compliant subcontractor models

• Reduced demand for young, minimum wage level operatives as firms prioritise experienced labour

• Only modest increases in apprenticeship intake due to delivery pressures

The Budget may not transform the sector, but it does reinforce something important. Digital infrastructure remains a national priority, which is positive for the entire industry. For us, this is encouraging. Hopefully it means the industry will stay busy, investment will continue and skilled labour will remain essential. We will keep supporting clients across the UK and Europe with well screened engineers who maintain productivity and compliance on every project.

Britons are consuming mobile data at record levels as younger generations shift away from traditional broadband and rely more heavily on smartphones.

Ofcom’s latest figures show that mobile data use in the UK has surged to more than 1.2 billion gigabytes each month in 2025. This is almost 20% higher than last year and marks a new national record. To illustrate the scale, this is equivalent to 400 million HD football matches, 315 billion TikTok posts or more than one quadrillion text-only WhatsApp messages.

4G still carries most of the nation’s mobile traffic, but 5G usage has risen by more than 50% over the past year. The trend highlights the dominance of smartphones and how heavily Britain now relies on mobile connectivity over fixed line broadband.

Full Fibre Rollout Rises But Adoption Lags

Full fibre availability has reached 78% of UK homes, up from 69% last year. However, only 42% of households with access have taken up the service. While this is higher than 35% in 2024, millions are still choosing not to upgrade to faster and more reliable fibre connections.

Analysts at New Street Research forecast a net decline of around 250,000 broadband subscribers this year. This would be the first fall on record and is particularly visible among Gen Z users in short term accommodation who are increasingly tethering devices to their smartphones.

Satellite And Wireless Alternatives Gain Momentum

Providers such as BT increasingly face competition from new technologies. Starlink passed 100,000 UK customers in 2025, driven by rural demand where fixed line infrastructure is harder to deliver.

Fixed Wireless Access is also gaining traction and is expected to be a major growth area for VodafoneThree following their 15 billion pound merger.

Networks Race To Keep Up With Demand

Mobile networks are under heavy pressure as data usage climbs. Outdoor 5G coverage now reaches 97% of the country from at least one provider, yet the UK still ranks lowest in the G7 for 5G download speeds. MPs have warned that inconsistent speeds are limiting productivity.

Operators are accelerating the rollout of standalone 5G which operates independently from older 4G systems. Ofcom reports that 83% of the UK now has access to standalone 5G from at least one network. This upgrade provides faster speeds and greater reliability and is essential for supporting the UK’s growing data requirements.

What This Means For The Data Cabling Industry

The rise in mobile data use might suggest declining demand for fixed networks, but the reality is the opposite.

In fact, it strengthens it. Higher mobile traffic increases pressure on the core network which relies entirely on fibre, structured cabling and data centre capacity. Mobile networks are only wireless at the first hop, and every increase in 4G and 5G usage pushes more load into the fixed fibre backbone and the data centres that power it. This drives continuous demand for new cabling, upgrades, backhaul routes and infrastructure expansion.

- Offices and Commercial Buildings Will Stay Wired

Although younger consumers rely on mobile connectivity at home, businesses cannot depend on mobile-only solutions. Companies require:

- • Reliability

• Consistent Bandwidth for Large Teams

• Resilience and Redundancy

• High Security and Controlled Environments

• Support for VoIP, CCTV, Access Control And AV

• Compliance And Audit Trails

Structured cabling remains the backbone of commercial connectivity. Wi-Fi and 5G still sit on top of a high-quality wired foundation.

- Demand For Cat6A and Fibre Is Growing

Across office fit outs and enterprise environments, Bauhaus is seeing rising demand for:

- • Cat6A Installations

• Multimode and Singlemode Fibre in Risers and Comms Rooms

• Containment Upgrades For Higher Density Installs

• Cabinet Swaps, Patching And Rack Reorganisation

• Data Centre Cabling As AI And Cloud Usage Accelerate

Even if residential fibre uptake is slow, commercial demand is increasing sharply.

- Fixed Wireless Access Still Requires Structured Cabling Engineers

Although FWA reduces reliance on last mile fibre for homes, it still needs:

- • Rooftop Installations

• Point to Point Alignment

• Internal Cabling to Network Distribution Points

• Power, Mounting and Commissioning Work

This creates ongoing demand for skilled cabling engineers, fibre techs and field engineers.

- Data Centre Growth Remains Strong

More mobile data means more pressure on:

- • Core Network Capacity

• Backhaul Fibre Routes

• Edge Data Centre Expansion

• Hyperscale Builds

Every gigabyte consumed on a mobile device still travels through data centres and fibre.

- Starlink Will Not Replace Structured Cabling

Satellite broadband has its place in rural homes but offers no real alternative for:

- • Commercial Offices

• Public Sector Buildings

• Healthcare

• Education

• Finance

• Logistics

• Data Centres

These environments require controlled, stable, wired infrastructure with predictable performance.

Final Thoughts

Mobile data usage is rising fast and younger generations may be choosing not to install broadband at home, but this shift does not weaken the structured cabling industry. It strengthens it. More mobile traffic increases the load on the core fibre network, on data centres and on the commercial infrastructure that keeps businesses connected.

For Bauhaus Recruitment, demand for structured cabling engineers, fibre specialists and data centre professionals remains strong and is likely to grow further as 5G expands and AI-driven data consumption accelerates.

Pizza Hut entering administration is another reminder of how tough things have become in hospitality. Once famous for its family buffets and all-you-can-eat deals, it’s another well-known name struggling to survive as costs keep climbing and customers watch their spending.

With business rates rising, food and staffing costs soaring, and people leaning towards cheaper, more casual options, many restaurants are being squeezed from every angle. It’s not that people have stopped eating out or ordering in, but they’re choosing value over experience. A quick pizza at home or a cheaper high-street meal often wins out over a sit-down restaurant visit.

From a data cabling and infrastructure point of view, the knock-on effect is clear. Fewer refurbishments, fewer new openings, and tighter budgets all mean less investment in structured cabling, Wi-Fi systems, and digital upgrades. Projects that might once have been planned alongside a rebrand or new layout are now being delayed or quietly dropped.

Interestingly, the retail sector, while facing many of the same cost pressures, is still pushing ahead with major technology investments. Stores are upgrading networks to support RFID systems, in-store analytics, and self-checkout solutions. These rollouts rely heavily on strong cabling and connectivity, and they’ve kept demand high for technical infrastructure work.

While hospitality seems to be slowing down, retail continues to invest, using technology to streamline operations, gather data, and stay relevant in an online-heavy world.

#Hospitality #Retail #DataCabling #Connectivity #Infrastructure

The Lost Art of Labelling

There’s something deeply satisfying about a perfectly labelled patch panel.

Every port in its place, every cable behaving, every label crisp, clear, and actually matching the documentation. It’s… beautiful.

But sadly, this level of order is becoming a dying art.

Too often, you open a comms cabinet and find chaos: cables criss-crossing like spaghetti, faded labels written in biro, and mystery connections that no one dares to touch. Somewhere, there’s always one port marked simply as “DO NOT UNPLUG”, the physical embodiment of fear.

Let’s be honest: proper labelling isn’t glamorous. It doesn’t get the applause that a perfect fibre run or a shiny new containment system does. But it’s the quiet hero of the data cabling world, the thing that separates a professional installation from a horror story.

Because when something goes down at 2 a.m., and you’re standing there with a head torch, sweating, trying to find Port 36A-03, that tiny white label suddenly becomes the most beautiful thing you’ve ever seen.

So, here’s to the data cabling engineers who label as they go.

The ones who align every tag, update every spreadsheet, and take pride in a cabinet that looks more like artwork than infrastructure.

This should be the standard, but sometimes it isn’t always the case.

You’re the unsung poets of patch panels.

And the world runs smoother because of you.